Credit Where It Is Due: Two Facts About Credit Cards

The Credit Card Market Has Become More Concentrated Over Time

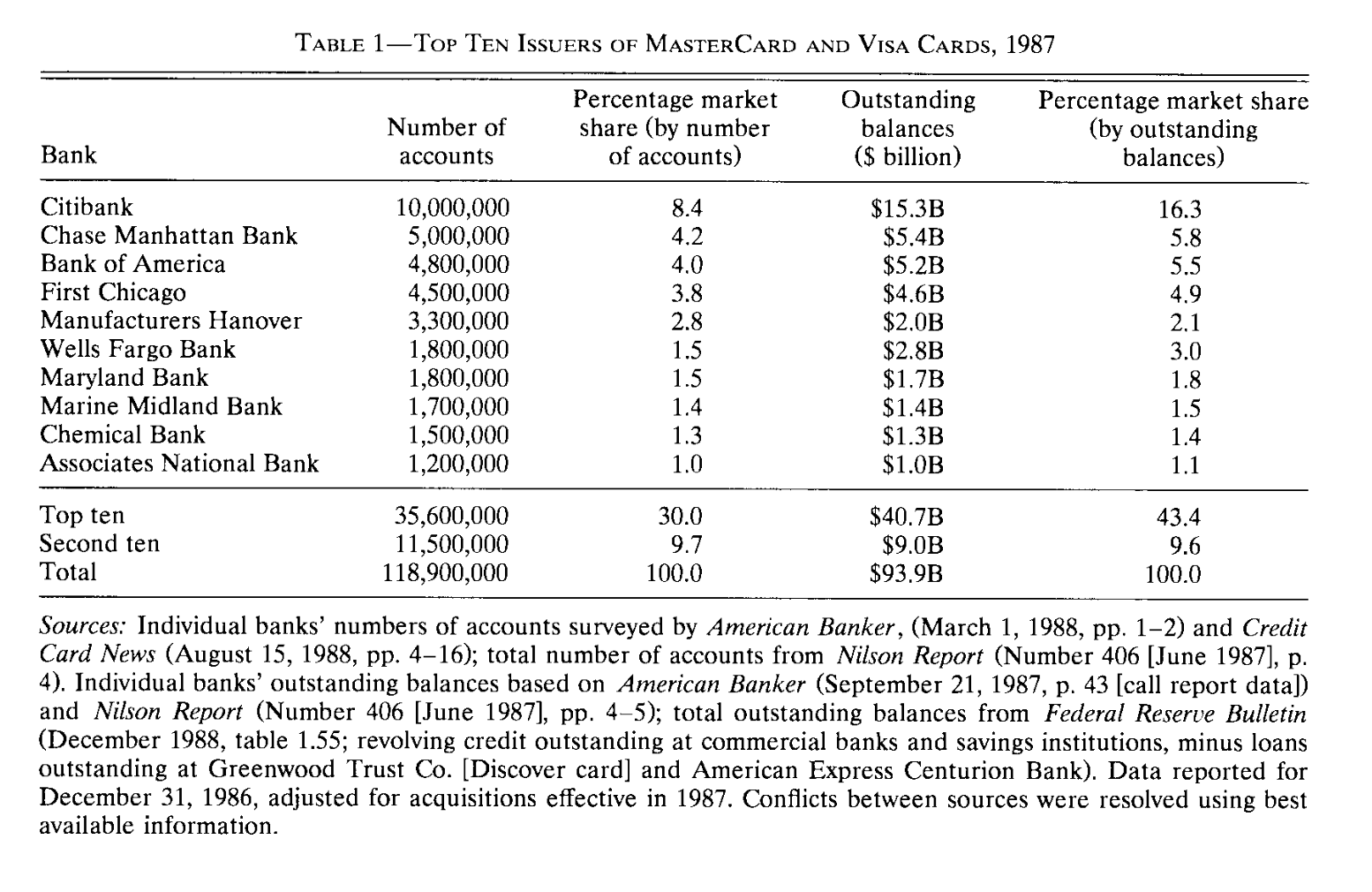

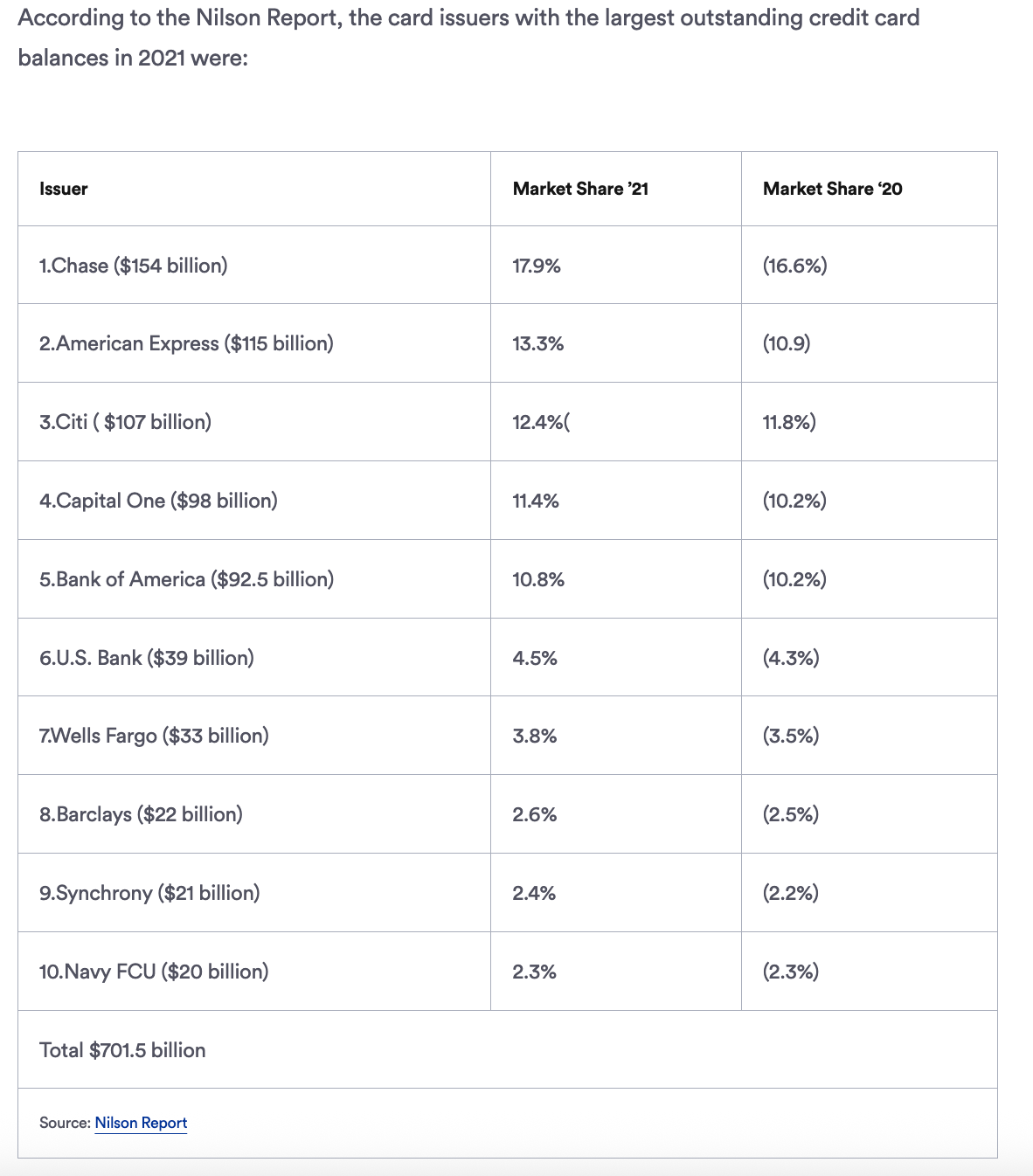

In 1987, the top 10 credit card issuers accounted for just about two-fifths of the market share based on outstanding balances.

In 2024,

"A relatively small group of card issuers holds most of the outstanding credit card balances, with the top 10 holding 81 percent." – Fed's Profitability of Credit Card Operations of Depository Institutions 2024 (PDF)

The Nilson Report from 2021 (via Bankrate) suggests ongoing consolidation.

Wealth Transfer From "Revolvers" to "Transactors"

There are three main sources of revenue for credit card companies:

- Transaction: network fee paid by the acquiring bank (the merchant's bank) to the issuing bank (the cardholder's bank). (~ negative contribution to profits given rewards and other expenses)

- Credit: interest income. (~ 80% of the profits.)

- Fees: usage fees, including late fees, over-limit fees, foreign exchange fees, and so on. (~ 16% of the profits.)

via the Federal Reserve's Report from 2022

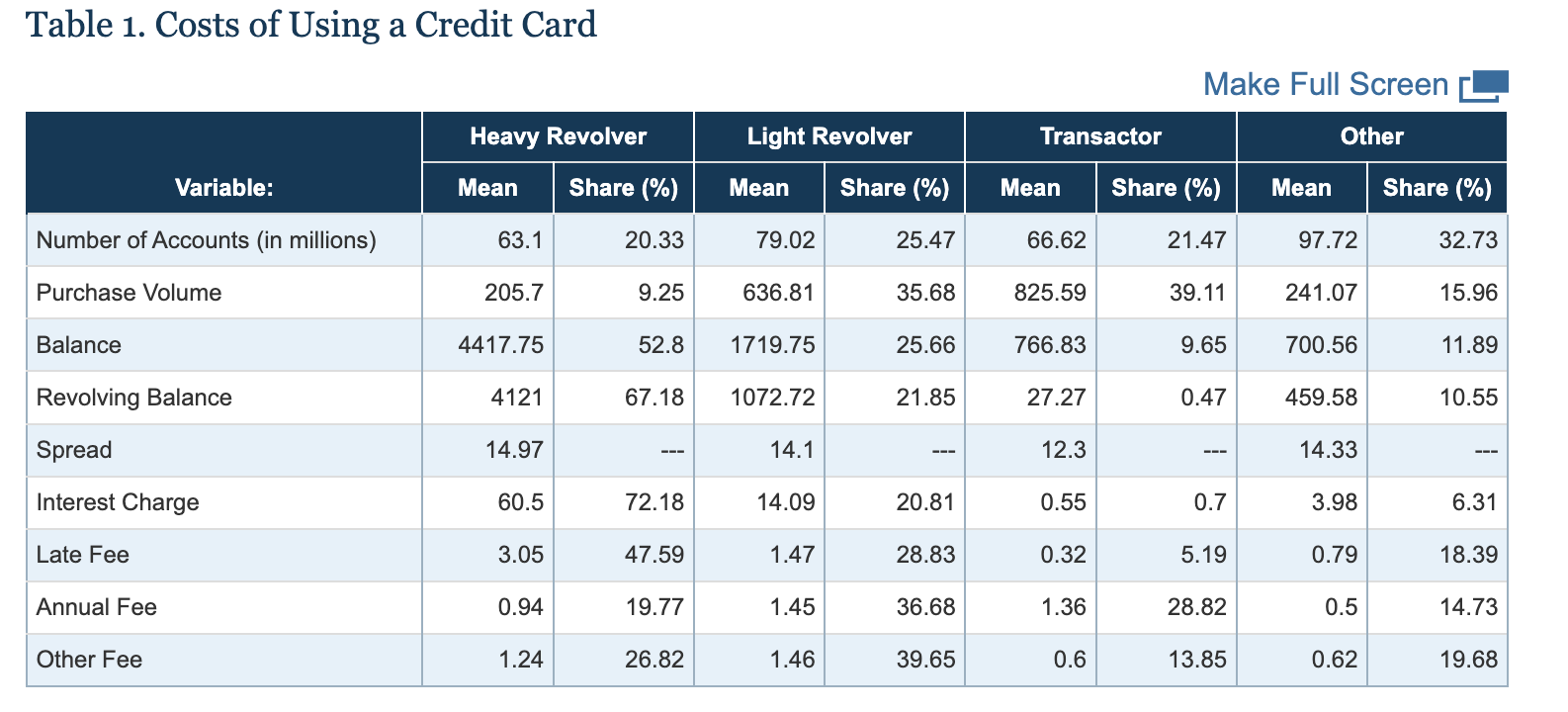

Next, they decompose interest income:

"We call accounts with a revolving balance every month in the past 12 months "heavy revolvers," accounts with a revolving balance in 1 to 11 of the past 12 months "light revolvers," and accounts that did not have a revolving balance "transactors." The remaining accounts are either new, and thus do not have the twelve-month history we require, or inactive and have not had a balance or made any purchases in six months."

In all,

"The bottom half of Table 1 examines how the costs of using a credit card vary with account usage type. The average heavy revolver pays more than 60 [dollars] per month in interest charges, and more than 70 percent of all interest is paid by heavy revolvers. Light revolvers pay 15 [dollars] of interest a month, making up about 20 percent of all interest. Similarly, heavy and light revolvers pay almost 50 percent and 30 percent of all late fees, respectively. By comparison, a higher burden of annual and other fees falls on transactors and light revolvers. Transactors pay almost 30 percent of all annual fees, whereas light revolvers pay 37 percent and heavy revolvers pay less than 20 percent.24 Nevertheless, the majority of annual fees are paid by revolver accounts. The summary statistics are broadly consistent with previous survey-based evidence of the costs of credit cards (for example, Stango and Zinman, 2009) and the biannual report on the credit card market issued by the Consumer Financial Protection Bureau.

It is notable that heavy and light revolvers pay not only the bulk of interest charges, but also the majority of credit card usage fees. Although usage fees are distinct from both the credit and transaction functions of credit cards, in practice, they appear to be paid mainly by the same accounts that use credit cards for their credit function. Since the credit function of credit cards comprises approximately 80 percent of profitability and fees comprise most of the remaining 20 percent, this suggests that the majority of credit card revenues are paid by revolvers."

Points For Higher Prices

Points are partly funded by revolvers, annual fees, higher prices by merchants, people who buy using cash and debit cards (except for those merchants, like some gas stations, that offer lower prices to those who use cash), and people who use credit cards with smaller rewards.

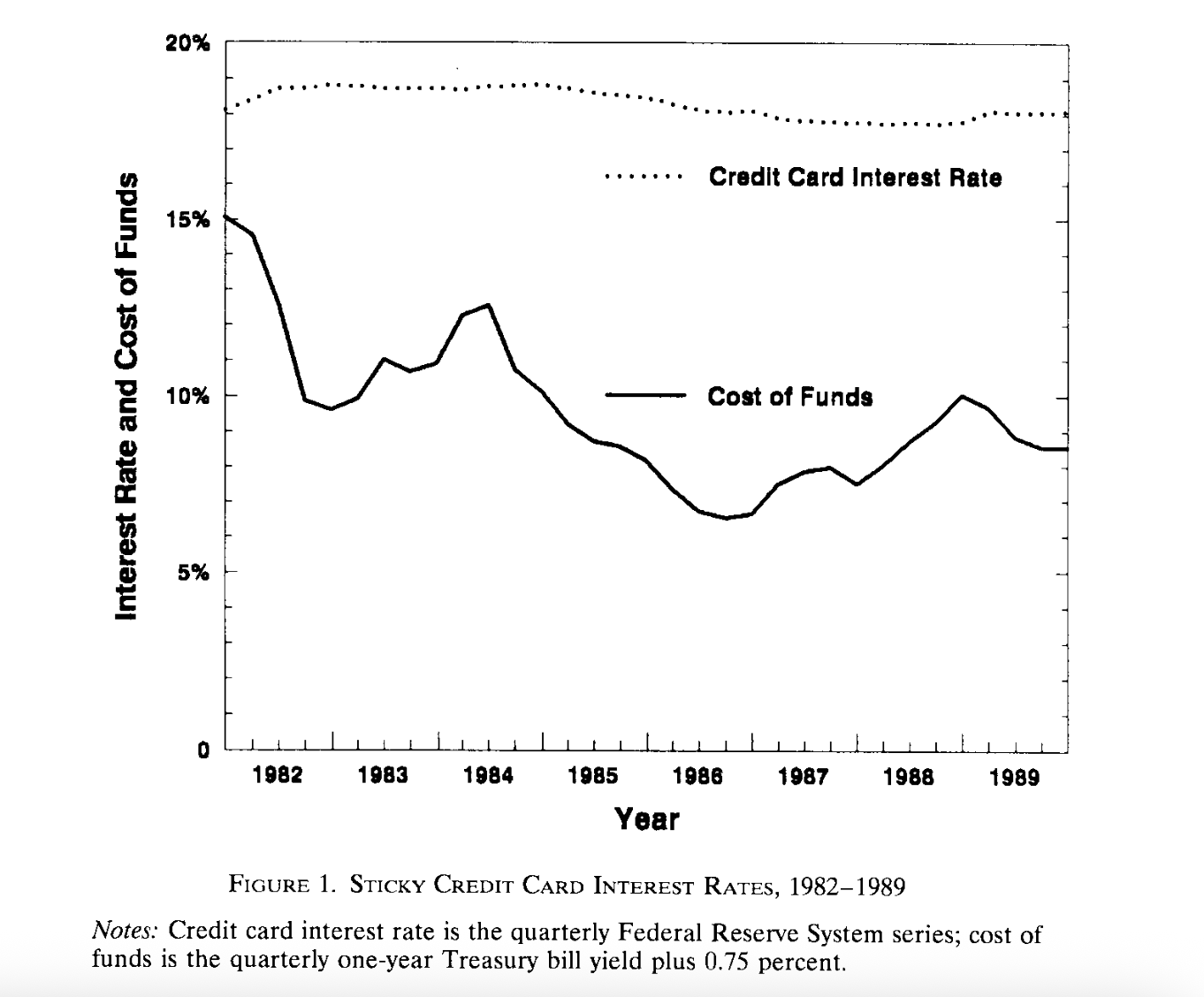

Bonus Material: The Interest Rate is Flat